18,685 hectares, 25 kilometers from Thompson Nickel Plant

Fjordland to have Staged Option to Earn Up To 80% Interest

Focus on Large Sulphide Nickel Targets with Tier-1 Potential

Vancouver, Canada, February 26, 2020 – CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) (“CanAlaska” or the “Company”) is pleased to announce that it has entered into a Letter of Intent (“LOI”) with Fjordland Exploration Inc. (“FEX”) to allow FEX to earn up to 80% interest in CanAlaska’s 100%-owned North Thompson Nickel Project in Manitoba, Canada (the “Project”).

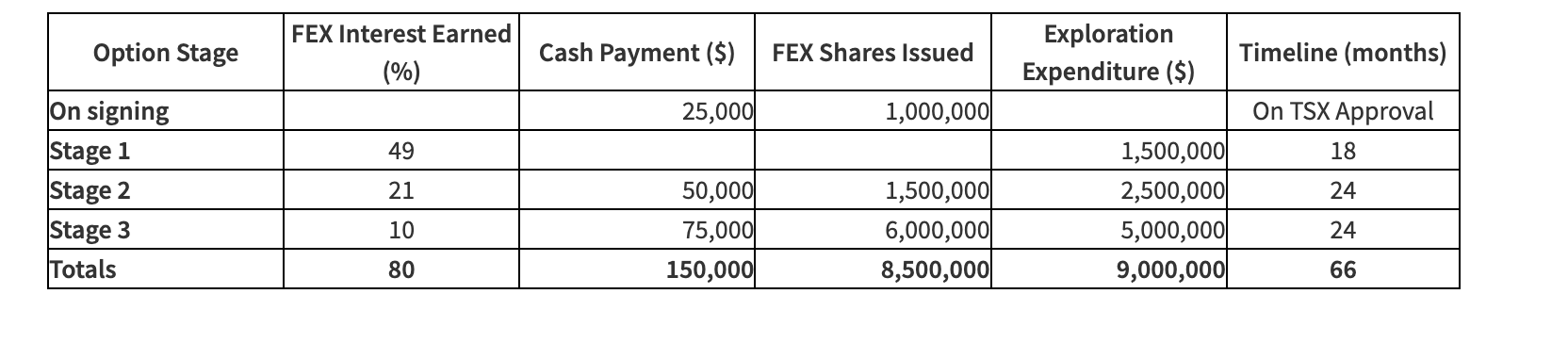

FEX may earn up to an 80% interest in the Project by undertaking work and payments in three defined earn-in stages. FEX may earn an initial 49% interest (“Stage 1”) in the Project by paying the Company $25,000 cash, issue 1,000,000 common shares of FEX, and incur $1,500,000 in exploration expenditures on the Project within 18 months of TSX Venture Exchange approval date. FEX may earn an additional 21% interest (“Stage 2”) in the Project by paying to the Company a further $50,000 cash, issue a further 1,500,000 common shares in FEX, and incur an additional $2,500,000 in exploration expenditures on the Project within 24 months of entering the Stage 2 option. FEX may earn an additional 10% interest (“Stage 3”) in the Project by paying to the Company a further $75,000 cash, issue a further 6,000,000 common shares in FEX, and incur an additional $5,000,000 in exploration expenditures on the Project within 24 months of entering the Stage 3 option.

After successful completion of either of Stage 1 or Stage 2 of the option agreement, and if FEX elects to not enter the next stage or in the case of completion of Stage 3, a joint venture will be formed and the parties will either co-contribute on a simple pro-rata basis or dilute on a pre-defined straight-line dilution formula. A summary of the various stages is contained in Table 1.

During Stage 1 and Stage 2 of the option agreement, CanAlaska will be operator of the Project. FEX will have sole voting rights on exploration programs while sole funding at the various option stages and will have the right to assume operatorship after successfully earning 70% interest in the Project (Stage 2).

FEX will issue a further 10,000,000 common shares in FEX upon completion of a positive Feasibility Study for the Project provided that FEX has earned, at a minimum, the 70% interest as outlined in Stage 2 of the option. If either of the Company or FEX dilute down to less than 10% Project interest, the party diluting will relinquish its remaining Project interest and a 2% net smelter return (“NSR”) royalty will be granted to the diluting party. In the event the Company is the party granted the 2% NSR royalty, the Company will be entitled to receive up to a maximum $10,000,000 CDN advance royalty payment (“ARP”) at commencement of commercial production on the Project, with the sum of the ARP payment being calculated based on 2% of the value of the capital expenditures to develop the operation.

An Area of Mutual Interest (“AMI”) will extend five kilometres from the outer boundary of the Project.

Table 1: Summary of Option Stages

North Thompson Nickel Project

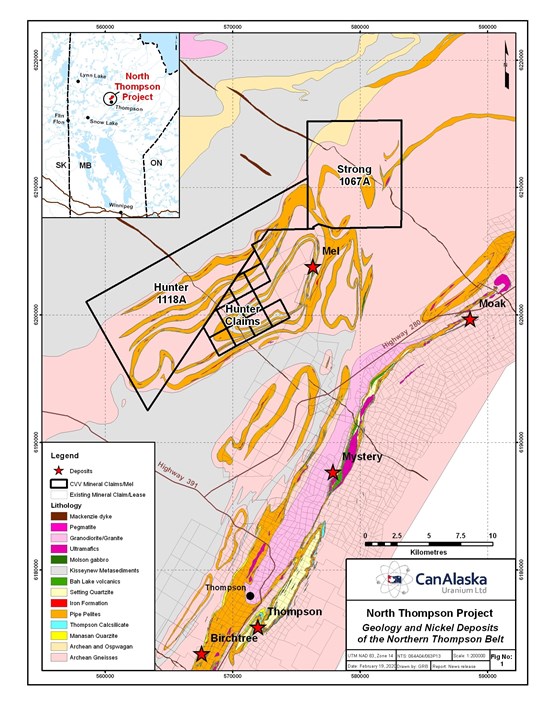

The Project consists of the “Strong” #1067A, the “Hunter” #1118A, and “Hunter Claims” with a total combined area of 18,685 hectares (Figure 1). The Project is located approximately 25 kilometres from the city of Thompson, Manitoba, with its existing mines and nickel processing facilities.

The Project covers most of the northern extension of the Thompson Nickel Belt, the fifth largest sulphide nickel belt in the world based on contained nickel endowment, the largest of which is the main Thompson Mine at an estimated 150Mt at an average grade of 2.3% nickel.

The Project area hosts the same geological and structural environment as the nearby Tier-1 Thompson Mine owned and operated by Vale but has seen essentially no exploration drilling since 2005. A detailed compilation of historical information of the Project, including a 2007 VTEM survey, provide a number of priority Tier-1 size drill targets that have never been followed-up with drilling.

The Project contain a series of high-grade nickel drill intersections from historical work that warrant follow-up with modern geophysics and drilling. The Mel deposit, with an Indicated plus Inferred resource of 5.3Mt at 0.87% nickel, occurs three kilometres east of the Hunter claims and the structure hosting the Mel deposit extends onto the Project.

CanAlaska President, Peter Dasler, comments; “Management is very pleased that Fjordland and their financing partners have been able to confirm the targets identified by the CanAlaska team. In addition, the application of their evaluation techniques have identified further targets at depth and along the trends of existing targets. We are looking forward to working with Fjordland to advance exploration on the Hunter and Strong properties.”

Other News

CanAlaska is currently conducting drilling at the West McArthur Uranium project in the Athabasca Basin, a joint venture with Cameco Corporation.

CanAlaska invites shareholders and investors to meet with management at booth number 2140 at the PDAC convention in Toronto between March 1 and 4, 2020.

About CanAlaska Uranium

CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) ) holds interests in approximately 152,000 hectares (375,000 acres), in Canada’s Athabasca Basin – the “Saudi Arabia of Uranium.” CanAlaska’s strategic holdings have attracted major international mining companies. CanAlaska is currently working with Cameco and Denison at two of the Company’s properties in the Eastern Athabasca Basin. CanAlaska is a project generator positioned for discovery success in the world’s richest uranium district. The Company also holds properties prospective for nickel, copper, gold and diamonds. For further information visit www.canalaska.com.

The qualified technical person for this news release is Dr Karl Schimann, P. Geo, CanAlaska director and VP Exploration.

On behalf of the Board of Directors

“Peter Dasler”

Peter Dasler, M.Sc., P.Geo.

President & CEO

CanAlaska Uranium Ltd.

Contacts:

Peter Dasler, President

Tel: +1.604.688.3211 x 138

Email: info@canalaska.com

Cory Belyk, COO

Tel: +1.604.688.3211 x 138

Email: cbelyk@canalaska.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will prove inaccurate, certain of which are beyond the Company’s control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.